Nine Years and Still Running: Reflections on the State of the PCAOB’s Interim Broker-Dealer Inspection Program

After the 2008 global financial crisis, to protect public markets, Congress passed the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (“Dodd-Frank Act”). As a result of the legislation, the PCAOB’s scope was expanded to include audits of broker-dealers and thus in 2011, the PCAOB began its interim inspection program.

The interim program was designed to assist the Board in developing a

permanent program and in June 2011, the Board proposed the following:

“If the Commission approves Rule 4020T, the Board anticipates carrying out procedures under the interim program until rules for a permanent program take effect. The Board anticipates being in a position to propose rules for a permanent program by 2013.”

-

PCAOB's Temporary Rule For An Interim Program Of Inspection Related To Audits Of Brokers And Dealers

As of the date of this article, there is no clear indication from the PCAOB when a permanent program can be expected.

Back in 2011, there were approximately 800 registered firms auditing approximately 4,400 broker-dealers that filed with the SEC. In the first inspection season, the PCAOB reviewed 23 audits across ten firms. Deficiencies were identified in audits from all ten firms. At the engagement level, the report provides detailed deficiency counts for each major focus area; one focus area had deficiencies in 21 out of 23 audits. In other words, approximately 91% of engagements reviewed were deficient in at least one area.

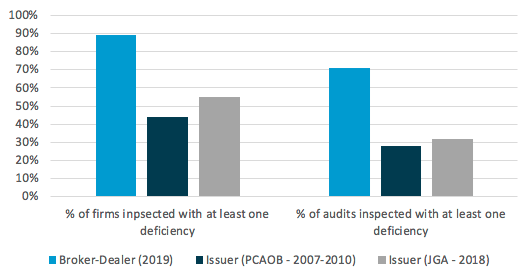

Nine years later, still under the same interim inspection program, the PCAOB published the 2019 Annual Report on the Interim Inspection Program Related to Audits of Brokers and Dealers1. In its ninth inspection season, the PCAOB inspected 66 firms and reviewed a total of 106 audit engagements. The report from 2019 shows improvement from 2018, but still shows an alarming number of deficiencies; 89% of the firms inspected contained at least one deficient audit and 71% of the audits inspected had at least one audit deficiency.

To put the broker-dealer figures in context, in the PCAOB’s last report from 2013 on firms that audit 100 issuers or less (the non-broker-dealer inspection program), the regulator reported that approximately 44% of audit firms inspected from 2007 to 2010 had at least one significant audit performance deficiency. At the engagement level, the PCAOB found that 28% of audits inspected from 2007 to 2010 had at least one significant audit performance deficiency. Based on JGA’s analysis of 2018 inspection reports issued, approximately 55% of all firms inspected had at least one significant audit performance deficiency and approximately 32% of engagements had at least one significant audit performance deficiency.

While issuer audit deficiency rates are still quite high, there is a marked difference between the two inspection programs. Why is the audit deficiency rate so much higher within the broker-dealer inspection program?

From our experience working with and supporting firms that audit issuers as well as firms that audit broker-dealers, we have found there are a few factors that could explain the discrepancy in quality:

Lack of PCAOB Knowledge and Experience

Until the Dodd-Frank Act of 2010, broker-dealer audits were not subject to PCAOB oversight and the audits were performed in accordance with AICPA auditing standards. In fact, AICPA standards were used for audits up until mid-2014. Yes, there are some large public broker-dealers (often affiliated with the large investment banks). However, considering there were over 4,400 broker-dealers at the start of the interim program, most of these brokers-dealers are smaller private companies that are often audited by smaller audit firms, many of which have no public company clients. That means, many of these audit firms have little to no experience with PCAOB standards.

In the 2019 broker-dealer report, the PCAOB indicated that of the 66 firms inspected, 29 of the firms had no issuer audits, or the equivalent of 44%. That’s a large percentage of audit firms that are required to comply with PCAOB standards, but aside from small broker-dealer audits, have no other exposure. When the interim inspection program began, there were over 800 registered audit firms that performed audits of broker-dealers. That number has since decreased to 411 firms, likely due to the cost of compliance and regulation.

Consolidation of the industry means fewer audit firms are auditing more broker-dealers which means they are getting increasing exposure to the PCAOB. More exposure to the PCAOB means more opportunities to master knowledge of PCAOB standards and hone those skills in practice. For example, in its 2013 report on firms that audit 100 issuers or less, the PCAOB noted that“ or the 455 firms that had a second inspection in the 2007- 2010 period, 36 percent had at least one significant audit performance deficiency in their second inspection, compared with a rate of 55 percent in their first inspection." 1 This correlation would seem to support that continued exposure to PCAOB audits and inspections would help improve audit quality over time. While we have seen remarkable consolidation take place, should firms that audit broker-dealers consolidate even more? The cost of regulation is certainly a factor for small firms to consider, but the quality of the audits and exposure for the public is another concern that should be taken into account.

Complexity of the Broker-Dealer Industry and Focus on Compliance

In my experience auditing broker-dealers and advising PCAOB-registered firms and their engagement teams, I have come to understand the complexity of the broker-dealer industry. When I previously worked in public accounting, I specialized in the asset management industry. As a result, the firm assigned me to a broker-dealer audit. I realize everyone must start somewhere, but was I the right person to manage the audit? I quickly learned about the industry and some of the nuances, but I didn’t know what I didn’t know.

The broker-dealer industry is complex and full of various legislation and has a significant focus on compliance. Considering I was at a Big 4 firm and they assigned someone with no experience, I can imagine smaller firms with fewer resources may struggle to have adequate knowledge or expertise of the industry. I have learned over time more about the industry and similarly, partners and managers may get experience over time, but there is certainly a learning curve until that expertise develops.

In addition, when the industry is so focused on compliance with technical rules and legislation, does that change the auditor’s perceived role? Does the focus become a compliance monitor as opposed to performing a standalone audit? A typical broker-dealer engagement includes the audit of the financial statements, but then also attestations over compliance and exemption rules as well as agreed upon procedures for required SIPC filings. On more than one occasion, when performing reviews of broker-dealer audits, I’ve heard clients respond, “well, it didn’t impact the net capital calc” or “they’re still in compliance, so it doesn’t matter.” That may be, but the opinion on the financial statements is still based on PCAOB audit standards and those standards are not secondary to compliance, but rather provide standalone audit requirements.

What is the role of the auditor in the broker-dealer industry? Is it broader than the role of the auditor in the issuer realm?

Lack of Accountability

Because of the nature of the interim inspection program, firms currently lack accountability to affect change and improve audit quality. There is no separate firm reporting and thus no mandatory firm remediation of quality control criticisms. Essentially, the inspection process stops with the comment form. Now, in 2020, even with an entirely new board, there is still no permanent program and I cannot seem to find any mention of creating one or prioritizing the creation of permanent program. In fact, the Board’s 2019 to 2013 strategic plan is silent to any movement toward the creation of a permanent program. In it’s 2019 interim inspection report, the PCAOB said: "We expect firms to take meaningful actions to address these recurring deficiencies." Sometimes "meaningful action" requires "meaningful action" on the part of the oversight authority. If the PCAOB can’t finalize and implement a permanent program, more than nine years after it started, what kind of “tone at the top” is that setting? How serious is the inspection program?

While we can debate the role of the auditor in the broker-dealer industry or debate the scope of the PCAOB’s inspection program or whether there is actually any public risk exposure for certain private broker-dealers, the fact of the matter is that under current regulations, all broker-dealer audits must be performed in accordance with PCAOB standards. And we, as an industry, must step up our efforts and to ensure quality audits. The high deficiency rates found by the PCAOB, despite being nine years into the interim inspection program, are much too high and show that there is room for growth and improvement.

So where do we go from here? For firms who audit broker-dealers, and as I think about how our collaboration with firms have been most effective, here are some suggestions:

- Review the 2019 interim report which highlights the most prevalent findings from the PCAOB.

- Consider whether the themes in the report apply to your own audits and your practice. Are there any risk factors in your system of QC or other monitoring information to corroborate this?

- If you’ve been inspected, while there are no firm-specific remediation requirements, review any comment forms you received and consider any remedial actions to prevent recurrence of the issue(s).

- Attend the annual Forum on Auditing in the Small Business Environment and for Auditors of Broker-Dealers. This PCAOB-hosted forum is free to attend and provides more insight into PCAOB findings and can help direct firms’ quality initiatives. 2

- Consider responses to identified risks based on the above procedures. Whether that includes in-flight or look-back reviews or having additional support during your next PCAOB inspection.

Hopefully, in nine more years, the interim program will be replaced by a risk-based permanent program. Until then, our mission as auditors is to provide quality audits to protect the public interest.

1 https://pcaobus.org/Inspections/Documents/02252013_Release_2013_001.pdf

2 On September 9, 2020, the PCAOB announced that the 2020 forum would be pre-recorded and available for viewing by the general public beginning October 19, 2020.

Dane Dowell

is a Director at Johnson Global Accountancy who works with PCAOB-registered accounting firms to help them identify, develop, and implement opportunities to improve audit quality. With over 12 years of public accounting experience, he spent nearly half of his career at the PCAOB where he conducted inspections of audits and quality control. Dowell has extensive experience in audits of ICFR and has worked closely with attorneys in the PCAOB’s Division of Enforcement and Investigations. Prior to the PCAOB, he worked with asset management clients at PwC in Denver, Singapore, and Washington, DC.

Johnson Global Advisory

1717 K Street NW, Suite 902

Washington, D.C. 20006

USA

+1 (702) 848-7084