Initial Observations: The New PCAOB Inspection Report Format

You probably have realized – especially if you have been waiting for yours -- there was a dearth of inspection reports published in the last two months. We assumed this pause in frequency and volume was to reengineer the reports in the queue into the new report format. However, that clearly is not the case.

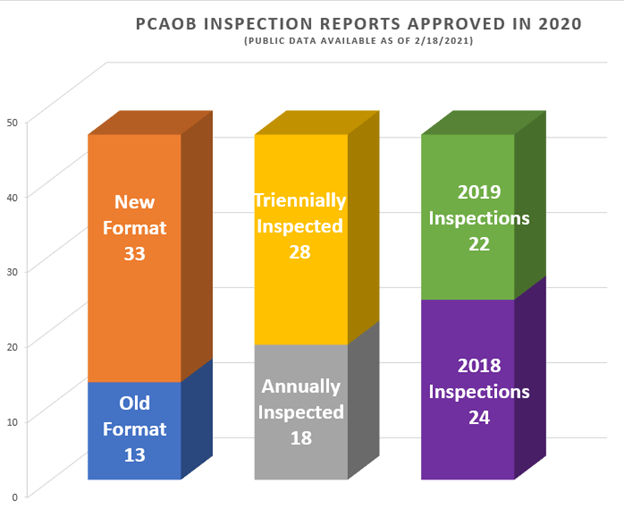

At the time of the release of this article, there have been 46 inspection reports issued with a report date during 2020. Of those 46 reports, 33 were under the new format while 13 kept the old format. JGA collects and analyses comprehensive firm information, inspection, and report data on a continuing basis to help us identify trends and keep our clients and readers informed. Here’s some of the characteristics on those inspection reports approved in 2020:

In the Spring of 2020, the PCAOB issued a guide to assist readers to understand the format of the new inspection report and expected changes in each section. Here are our initial observations:

First, there is no executive summary for triennially-inspected firm reports, and no firm demographic data for annually-inspected firms. In the annually inspected firm reports, the executive summary provides a high-level review of the deficiencies identified by breaking them out between ICFR audits or non-ICFR audits and quickly describes the most common deficiencies identified in that inspection along with a brief summary the Part I findings. This executive summary is excluded from the triennially-inspected firm inspection reports. Additionally, while firm demographic data (e.g. number of issuer audit clients and number of engagement partners with primary responsibility for issuer audits) was always in all reports, it is now excluded from the annually-inspected firm reports.

Randomly-selected audits are reported for annually-inspected firms only. As you probably know, this has been an ongoing topic over the last several years and one that is frequently discussed in public comments by inspection leadership and by Board members. We now see more insight into whether and how many audits were randomly selected by the inspection team. It seems this is now reserved for annually-inspected firms only. In our work with clients supporting them through the inspection process, we have not seen instances where triennially-inspected firms are subject to a random selection. But as with most initiatives, changes start with the larger firms and trickle down to the smaller firms over time. And clearly, firms with only a few issuers, should be immune to this as well.

Focus areas selected by the inspectors are clearly reported. In the past, readers would only know what those areas were if there were deficiencies identified in those areas. The section titled “Audit Areas Most Frequently Reviewed” depicts most, if not all, of the audit areas reviewed for small firms. This new public information provides stakeholders with much more transparency into the complexity of the audits reviewed (i.e. shell companies with no revenue versus operating companies). In addition, with a broad analysis of report data across firms, we can understand what inspectors are focusing on and identify any new trends in focus areas.

A new section brings more findings into the public domain. We previously wrote about this new Part I.B and the Board’s remarks on what types of deficiencies would appear in this section. Based on our review, examples in this section include:

- non-compliance with audit documentation,

- required communications to audit committees (including pre-approval of non-audit services),

- timeliness and accuracy of Form AP reporting,

- required management representations, and

- non-standard audit report language.

RELATED: Recap of PCAOB Hot Topics at the AICPA National Conference

The non-public section on quality control draws broader observations over a firm’s overall QC system. There are examples where an observation is identified in one audit and the Board concluded that the Firm’s system of QC does not provide reasonable assurance over this particular area. Based on our analysis and our work with firm clients to design and implement remedial actions, this appears to be a change from the previous report format. This has spurred many client conversations about whether a particular observation means a specific system of QC is insufficient. Additionally, concerns about root cause analysis continue to rise. We will continue to monitor these changes because they have a direct effect on the effort required for firms over remediation.

Root cause assessments are omitted from the new reports. Over the last several years, the PCAOB has been including its own assessment of the root cause of the quality controls findings in the private portion of inspection reports. However, this no longer seems to be the case as this section has been omitted from current triennially-inspected firm reports. Previously, common assessments included were due care and professional skepticism, supervision and review, technical competence, or others. This change is in line with what we believe is in the best interest of these firms too. Firms are better equipped to narrow down the precise root cause and have a full understanding of their issuer practice and system of QC. Leaving root cause assessments to the firm will open more dialogue with remediation staff, allowing firms to set the direction that remedial actions should take.

We encourage our clients and other firms to take a close look at each of these sections when you receive your draft inspection reports and contact us if you would like additional insight to interpret the findings and discuss the right action plan.

Jackson Johnson is president of Johnson Global Accountancy, a public accounting and consulting firm with clients throughout the world. He works directly with PCAOB-registered accounting firms and other firms to help them identify, develop, and implement opportunities to improve audit quality.. He also works with public and private companies on various technical accounting and transactional matters. His experience includes nearly six years with the PCAOB, where he worked with small and medium-sized accounting firms throughout the world, including foreign affiliates of large international accounting firms, in the areas of firm quality control and ICFR audits of financial statements. Prior to the PCAOB, Johnson worked with public and private clients in a variety of industries at Grant Thornton LLP in Boston, Los Angeles, and Hong Kong.

Joe Lynch, JGA Shareholder, to Provide Insights on Changes to Engagement Quality Review Requirements